Cuba’s financial crisis worsens: economy minister

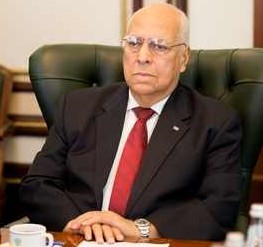

HAVANA (Reuters) – Cuba’s two-year-old financial crisis worsened during the first half of this year, and the country is having difficulty obtaining trade credits due to late payments to suppliers, according to Cuban Economy Minister Ricardo Cabrisas.

In a report to a closed door session of the National Assembly on Friday, which was broadcast by state-run television on Monday evening, Cabrisas said export revenues through June were short of expectations by $400 million.

Cabrisas said imports in 2017 would decline again and be $1.5 billion less than planned “due to difficulties in using credits, limits assigning liquidity and debts on expired letters of credit that have not been paid.”

A cash crunch and lower oil supplies from political ally Venezuela forced the Caribbean island to slash imports and reduce the use of fuel and electricity last year, helping tip its centrally planned economy into recession for the first time in nearly a quarter century.

The economy expanded 1.1 percent through June this year, Cabrisas said, thanks to a tourism boom and growth in agriculture, construction and a few other sectors.

However, Cabrisas said if last year 85 percent of imports were financed through commercial credits, through May the country had managed to obtain similar financing for just 40.8 percent as suppliers balked at piling up more debt.

That means the cash-short and import-dependent country must seek more government debt for supplies.

Since oil prices slumped in 2014, Venezuela has reduced shipments of subsidized fuel to communist-run Cuba, as well as payments for Cuban professional services.

Venezuela’s oil and fuel deliveries to Cuba slid almost 13 percent in the first half, according to documents from state-run oil company PDVSA viewed by Reuters, and were down 40 percent from the same period in 2015, forcing Cuba to purchase some fuel from former benefactor Russia.

Cabrisas said Cuba was forced to seek fuel on the open market and had spent $99.6 million in addition to what had been planned.

Other oil-producing allies, such as Angola and Algeria, also find themselves short of cash to pay for Cuban services.

A boom in tourism has not been enough to stem the hemorrhaging of hard currency as production and prices of key export earners refined oil products and nickel have also fallen in a country embargoed by the United States.

Cuba does not publish up-to-date information on its debt, balance of payments and current account.