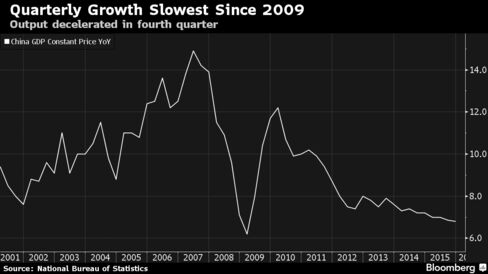

China GDP Slows to Weakest Since 2009 on Manufacturing Slide

China’s economy slowed in December, capping the weakest quarter of growth since the 2009 global recession, as the Communist leadership grapples with a transition to consumer-led expansion.

China’s economy slowed in December, capping the weakest quarter of growth since the 2009 global recession, as the Communist leadership grapples with a transition to consumer-led expansion.

Industrial production, retail sales and fixed-asset investment all slowed at the end of the year, while gross domestic product rose 6.8 percent in the fourth quarter from a year earlier. Full-year growth of 6.9 percent, the least since 1990, was in line with the government’s target of about 7 percent.

Policy makers must weigh the need for further monetary easing with the risk it would spur more weakness in the yuan and additional capital outflows. Arguing against major stimulus: a rise in services, which became more than half of the economy for the first time, cushioned the slowdown and underpinned employment.

“2016 will be another challenging year as the old capital-intensive, highly levered industrial sector continues to be placed under severe strain,” said Kenneth Courtis, former Asia vice chairman at Goldman Sachs Group Inc. and now chairman of Starfort Holdings. “But we remain constructive on the outlook for the period ahead,” he said, citing steady job gains and retail sales that are rising faster than GDP.

Industrial production posted one of the weakest gains in the past quarter century, increasing 5.9 percent in December from a year earlier, compared with a 6 percent median estimate of analysts and November’s 6.2 percent.

Retail sales increased 11.1 percent from a year earlier, compared with the 11.3 percent projected by economists. Fixed-asset investment excluding rural areas expanded 10 percent last year, the slowest pace since 2000.

The Shanghai Composite Index closed 3.2 percent higher as the data fueled speculation of increased stimulus and industrial shares rallied on prospects of state-fund buying.

Deflation Pressure

Bloomberg’s monthly GDP tracker slipped to 6.69 percent in December, from 6.85 percent a month earlier. A measure of economy-wide inflation slipped deeper into negative territory, declining 0.5 percent in 2015, according to another Bloomberg gauge.

“Deepening of deflationary pressures require more decisive reflationary policies,” economists Julia Wang and Li Jing at HSBC Holdings Plc wrote in a report. “Both monetary and fiscal easing measures are needed to help support demand and anchor expectations.”

HSBC forecast a quarter percentage point interest-rate cut and 100 basis-point reserve ratio reduction this quarter, plus a wider fiscal deficit target for the year.

IMF Outlook

In an update to its annual outlook published Tuesday, the International Monetary Fund left its estimate for China’s growth this year unchanged at 6.3 percent even as it lowered the global projection to 3.4 percent. The fund said risks to the global outlook remain tilted to the downside, with the world facing three big adjustments: the emerging-market slowdown, China’s shift to growth driven less by exports and manufacturing, and the Federal Reserve’s gradual exit from ultra-low interest rates.

China’s top leadership has signaled in recent months it may allow some additional slowness as officials tackle delicate tasks such as reducing excess capacity, but nothing that could threaten President Xi Jinping’s goal of at least 6.5 percent growth through 2020. The world’s second-largest economy will slow to 6.5 percent this year and 6.3 percent next year, according to the median of economist estimates.

Reaching the official 6.5 percent target “is fast becoming a challenge,” Shen Jianguang, chief Asia economist at Mizuho Securities Asia Ltd. in Hong Kong, said in a note.

China’s economy is going through a “tough transition to make, but critical if growth is to be sustainable,” former Fed Chairman Ben S. Bernanke said at a forum Tuesday in Hong Kong. “You have to have a transition to more services if you want to keep the economy growing and providing jobs.”

Two-Speed Growth

China’s economy is growing at two speeds, with old rust-belt industries from steel to coal and cement in decline while consumption, services and technology do better. Services accounted for 50.5 percent of output last year.

The policy response to last year’s slowdown included accelerated monetary easing with six interest-rate cuts since late 2014 and increased fiscal spending. Through market turbulence, the central bank forged ahead with interest-rate liberalization by removing a cap on deposit rates and won the IMF’s approval for the yuan to enter its Special Drawing Rights basket of reserve currencies.

This year, attention is likely to turn more to a new focus on supply-side reforms such as slashing excess industrial capacity and labor in state enterprises, cutting taxes and boosting productivity.

“China’s monetary policy should remain extremely accommodative,” said Zhou Hao, an economist at Commerzbank AG in Singapore. “While headline growth looks fine, the breakdown of the figures points to overall weakness in the economy. More importantly, recent market turmoil warns many of the weakness of China’s economy and its financial system.”